Private equity (PE) firms are involved in investment in private and unlisted companies, operational management, and fundraising. PE firms raise capital from investors or Limited Partners or high net-worth individuals. PE firms act and improvise the company they bought and sell them for a return on investment. When the asset’s value increases by 2x to 10x, the investors reap all the profits.

Generally, the private equity industry invests in all types of industries – tending to larger deals, acquiring mature companies, and operating portfolio companies during its hold period. They are referred to as growth equity funds, leveraged buyout funds (LBO), Mezzanine funds, real estate funds, infrastructure funds, funds of funds, etc. Moreover, they acquire majority stakes or full company through debts and equity.

Here is a quick rundown of the recent successful deal closures in the private equity industry:

- Vertica Capital Partners is an NYC based PE firm recently closed its $205 million maiden fund

- Bregal Sagemount, another NYC-based growth-focused PE firm closed its Fund III for $1.5 billion

- Huntsworth’s shares have skyrocketed after a US-based PE firm agreed for a takeover deal worth £400m.

- PE firms acquire Smith Technologies in the Spartan burg

- The Canadian PE industry capital investment peaked at $62 billion, an up from the $57 billion recorded in 2017 and 2018.

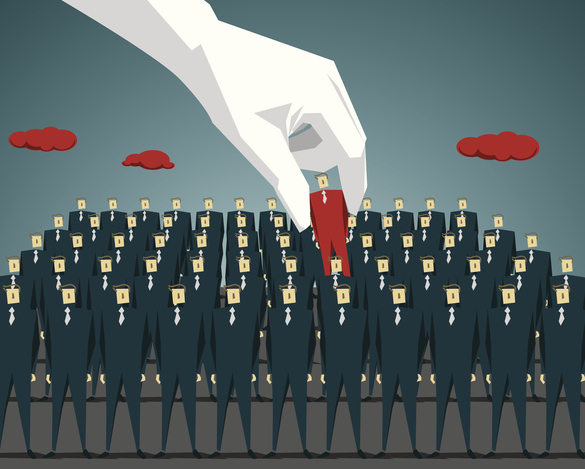

Getting a career in private equity is challenging as the recruitment process is structured and on-cycle. Smaller PE firms opt for the ‘off-cycle’ recruiting process. Still, PE attracts an enormous number of candidates into its fold as they offer high salaries, compensation, bonus, carried interest, and interesting work hours. Professionals enjoy working with PE firms as they get exposed to in-depth operations and large deal closures.

With this background, let us see what PE firm is for an analyst.

An analyst in the private equity industry gets engaged in almost all functions of the private equity firm. They have exposure to the deal process from origination and due-diligence through deal structuring and post-investment portfolio management as well.

The entry-level jobs in private equity include Analysts and Associates. The PE analyst gets hired straight away from the business school. Associates have working experience in investment banking and driving deals to completion.

To get into a private equity career, you need an MBA graduation, internship, work experience in financial modeling, a strong network, think critically, be unique, and culturally fit. Many professionals strengthen their resume by earning PE certifications while looking for a private equity job. Apart from technical proficiency, you must have skills like strong skills like people skills, analytical skills, valuation skills, and allied skills.

Private equity analyst:

A PE Analyst primarily conducts research, ratio analysis, and interprets about private companies. The analyst assesses the benefits of investing in a said company by using due diligence, financial modeling techniques, and valuation methods. They raise money from banks, high-net-worth individuals, and private companies to maximize returns. They are experts in defining the usage of investment and forecasting the return on investments.

Let us delve deep into the roles and responsibilities of a private equity analyst.

Roles and Responsibilities of PE Analyst:

Some of the major responsibilities and extended learnings of a PE analyst are jotted down here.

Valuation:

The market price of the target companies is unknown and the stock pricing in the market is not determined. It is the core responsibility of an analyst to provide an accurate valuation of the company’s shares.

Statement analysis:

Analysts must determine whether the investment in a select company meets the funds objective. The analyst must conduct a thorough financial statement analysis, calculate, and present the projected earnings accurately.

Structure capital:

Many times, PE firms may change the capital structure of their investing company. The analyst has to work on financial scenarios, determine the optimal mix of equity and debt to maximize the return on investment for the firm.

Deal execution:

The analyst must make sincere efforts to take ownership of deliverables. Though they do not actively take part in deal negotiation, it is advised to learn the legal nuances and negotiation skills. It is appreciated if they can devote extra time to understand private placement memorandums, shareholder agreements, legal terms and impact on finance. Over time, they can participate in the counsel of deals.

Relationship management:

It is recommended to maintain a good relationship with stakeholders, experts, counsels, and many more. It helps to understand their unique perspectives on transactions. Advanced knowledge helps to make a successful deal closure in the future. Maintaining relationships with multiple players of the market enriches your field knowledge.

Business development:

It is recommended to attend conferences, develop a strong network, discuss fund strategy, and share and gain knowledge. Though you may not convert always, connections establish a long-standing relationship and allow learning new things.

Portfolio management:

It is a good learning phase for an analyst. Analysts can take time to visit the leadership team, have an on-site visit, interact with the officers and learn about funds. It gives an opportunity to understand where the fund exactly adds value and creates an impact.

Field questions with C-Suite:

An open discussion with C-suite members improves your knowledge about deals and its closure. It helps you gain comfort in mapping revenue, crunching large volumes of financial ratios, and derive a sense of it.

Moving forward, let us understand the limitations and exit opportunities in the field.

Limitations and exit opportunities for a PE Analyst:

Though there is a long list of benefits and learnings, all efforts come with a cost. Let us see what a PE analyst loses while gaining so much knowledge and money. Though this aspect of a PE analyst is less talked about, it is necessary to know this too.

The working hours are beyond 10 AM to 6 AM for most of the days. PE analysts might have to sacrifice weekend plans during live transactions. A lot of effort is needed while structuring a deal and all deals might not end up with successful closure. All efforts and hours to close a deal may go in vain without tangible income. You may not be in a position to drive decision making or influence the board as an analyst.

There are numerous windows open for an exit. The exit opportunities for an analyst is promising. A PE analyst may shift to other broader PE industry, attend business schools to pursue an MBA, or shift to operating roles too. In general, your career gets progressed from Analyst →Associate→ Senior Associate→ Vice President→ Director or Principal →Managing Director or Partner.

Wrapping Up:

I hope now you are clear about the roles and responsibilities of a PE Analyst. This might help you to decide your career in the PE domain. Being a PE analyst, it provides you with valuable experience and learnings.

If this inspires you, get ready to gain a career in PE firms.

Ariaa Reeds is a professional writer who curates articles for a variety of online publications. She has extensive experience writing on a diverse range of topics including business, education, finance, travel, health and technology.