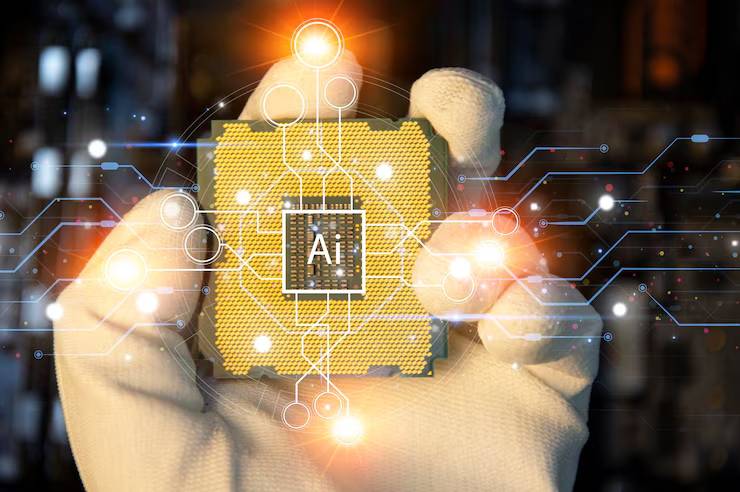

The integration of Artificial Intelligence (AI) into finance is transforming the industry by enabling more precise decision-making, automating processes, and improving customer interactions. Financial institutions that leverage AI are seeing substantial benefits, including enhanced risk management, operational efficiency, and customer satisfaction. This shift is setting new standards in the financial sector.

Current Trends in AI in Finance

Artificial Intelligence in finance is growing significantly, with many institutions embracing advanced technologies to stay competitive. Predictive analytics, machine learning, and natural language processing are among the key AI applications driving this trend. Financial firms report substantial improvements in efficiency and accuracy, highlighting the transformative impact of AI.

Predictive Analytics in Finance

The adoption of predictive analytics in finance is transforming the industry by enabling more accurate forecasting of future trends. Financial institutions use this AI-driven technology to analyze historical data, helping them make informed decisions about risk management, investments, and customer service. Predictive analytics is essential for optimizing operations and staying competitive in the financial sector.

Investment in AI Technologies

Investment in AI technologies within the financial industry is on the rise, driven by the need for improved efficiency and competitive advantage. Financial institutions are allocating substantial resources to develop and implement AI solutions, with market projections indicating a significant increase in AI-related spending over the next few years.

Enhancing Efficiency through AI in Financial Processes

The automation of financial processes using AI technologies is transforming the industry. By automating repetitive tasks like data entry, transaction processing, and regulatory compliance, financial institutions can operate more efficiently. This shift allows staff to focus on more strategic activities, improving overall productivity and service quality.

Revolutionizing Financial Services with NLP

Natural Language Processing (NLP) is revolutionizing financial services by enabling more efficient data processing and customer interactions. Financial institutions use NLP to analyze vast amounts of unstructured data, automate report generation, and enhance customer service through intelligent chatbots.

Emerging AI Trends in Financial Services

The future of AI in finance is marked by significant advancements and innovations. Projections indicate that AI investments will reach over $12 billion by 2026. Trends to watch include AI-powered financial advisory services, improved fraud detection through machine learning, and the use of AI for dynamic risk management.

Leading Examples of AI Implementation in Finance

Wells Fargo: Streamlining Fraud Detection

Wells Fargo has effectively integrated AI into its fraud detection systems. By using machine learning algorithms to analyze transaction patterns, the bank can identify and prevent fraudulent activities in real-time. This AI-driven approach has led to a 40% reduction in fraud incidents, significantly enhancing the bank’s security measures and customer trust.

Bank of America: Improving Customer Engagement with AI

Bank of America has embraced AI to enhance customer engagement through its virtual assistant, Erica. Erica uses natural language processing to understand and respond to customer inquiries, providing personalized financial advice and transaction assistance. This AI-powered tool has improved customer satisfaction by 35% and reduced the workload on human customer service representatives.

HSBC: Optimizing Compliance with AI

HSBC employs AI to streamline its compliance processes. By leveraging AI technologies to monitor transactions and detect suspicious activities, HSBC can ensure regulatory compliance more efficiently. This integration has reduced compliance costs by 25% and improved the bank’s ability to detect and respond to potential compliance issues swiftly.

Key Lessons and Best Practices

- Proactive Fraud Prevention: Implementing AI for real-time fraud detection can significantly enhance security and reduce financial losses.

- Enhanced Customer Interaction: Utilizing AI to provide personalized customer service can lead to higher satisfaction and reduced operational costs.

- Efficient Compliance Management: AI can streamline compliance monitoring and reporting, reducing costs and improving accuracy.

- Continuous Innovation: Regular updates and enhancements to AI systems ensure they remain effective and relevant.

AI: The Future of Financial Services

To sum up, Artificial Intelligence has revolutionized the financial industry, driving significant improvements in efficiency, accuracy, and customer satisfaction. AI’s ability to analyze vast amounts of data in real time has transformed risk management, fraud detection, and customer service. As we look to the future, the continued adoption of AI technologies with Ibiixo Technologies will further enhance financial services, leading to a more innovative and customer-centric industry. The potential for AI in finance is limitless, setting the stage for a new era of financial innovation.

Niyati is a Digital Marketer & Content Strategist at Ibiixo Technologies PVT. LTD. She takes care of the Digital visibility of Ibiixo. Ibiixo is a US-based company that provides functional solutions for your business to enhance the customer experience. It enriches business with websites and mobile app. Ibiixo works on various niche markets that include Real Estate, Insurance, E-commerce, Social Networking, Jobs and Career, Education, etc. Also, it has expertise in developing Custom Web & Mobile App Clones for various B2B and B2C Platforms like Vacation Rental, Service Marketplace, Social Networking, Real Estate, Educational, Online Taxi Booking, Artificial Intelligence, Augmented Reality, Virtual Reality, Uber for X, etc.

![[Solved] How to Recover Deleted Tasks in Outlook](https://onlinedrifts.com/wp-content/uploads/2020/02/recover-deleted-tasks-in-outlook.png)